Risk management when trading gold

Gold prices can move sharply, so managing risk is just as important as spotting a good setup. News and gaps can have a big effect on your trade, and even a small position can lead to big swings when volatility spikes, especially if you’re using leverage. Protect your capital.

Use leverage carefully

Many brokers let you trade gold with very high leverage, but that doesn’t mean you should. In the EU and UK, retail traders are limited to 1:20 leverage on gold, but outside of those regulated markets, some offshore accounts allow 1:500 or more. That kind of exposure can wipe out your balance after a small price move. Use the lowest leverage that still gives you flexibility. You don't want a 1% move in gold to be a threat to your solvency.

Set stops with market volatility in mind

Gold’s daily range can be wide, so fixed-size stops don’t always make sense. Instead, many traders base their stop-losses on the Average True Range (ATR), which measures recent volatility.

Position sizing

Let’s say you have a $10 000 account and want to risk 1% per trade ($100).

If your stop-loss is $5 wide, you can trade 0.2 lots on XAUUSD (since each $1 move equals $10 per 0.1 lot). That way, a $5 loss per ounce equals your $100 risk limit.

Watch overnight financing costs

When you hold gold positions overnight, your broker applies a swap or rollover fee. These costs reflect the interest rate difference between gold (a non-yielding asset) and the funding currency, such as the USD. If you hold trades for days or weeks, these small charges can add up, especially for larger positions. Always check your broker’s swap rates and factor them into your plan.

Control emotion

Gold’s quick swings can tempt you to overtrade or move stops. Stick to your plan. Decide on reasonable entries, stops, and targets before opening positions, and never take risks by attempting to recover losses.

Trade mechanics and costs

Before you place a trade on gold, it helps to know how the numbers work behind the scenes.

Pip or tick value

Gold (XAUUSD) is quoted in dollars per ounce. On many platforms, the smallest move - one cent or $0.01 - is labeled a “pip” for convenience.

If 1 pip = $0.01, then a $1 move is 100 pips.

1.00 lot = 100 oz → $1 move = $100.

0.10 lot = 10 oz → $1 move = $10.

0.01 lot = 1 oz → $1 move = $1.

Some brokers define a pip as $0.10 instead of $0.01. Always check your contract.

Margin requirements

Margin depends on leverage and the contract value.

At $4000 per ounce:

1 lot is 100 oz, so the contract value is around $400 000.

With 1:20 leverage, your required margin is around $20 000.

Higher leverage means you can control a bigger trade with less money, but it's riskier. Every price move counts more, and a small move can swing your profits or losses by a lot.

Spread and commission

You pay the spread when you enter. For gold, spreads often sit around $0.10 to $0.30 per ounce, depending on the broker and market conditions. Some platforms also charge a commission for each trade, usually $6 to $10 for an opened and closed trade.

Overnight swaps

Hold a position past the rollover time and you’ll pay or receive a swap. Gold doesn’t pay interest, so long positions often incur a small daily cost, while shorts may sometimes receive a small credit. Rates vary by broker and by interest conditions, so check how your platform works.

Example at $4000

You buy 0.10 lot of gold. The price goes from $4000.00 to $4005.00.

Profit or loss before costs: $5 move × $10 per $1 move = $50.

Spread cost: If the spread is $0.20, then 10 oz × $0.20 = $2.

Overnight swap: If you hold it for one day, assume about a $1 to $3 cost for this size.

Net profit after costs: Around $45 to $47.

Every gold trade carries costs. Know your pip or tick definition, confirm your margin, account for the spread and any commissions, and factor in swaps if you plan to hold overnight. This helps you size positions sensibly and avoid surprises.

Common mistakes when trading gold

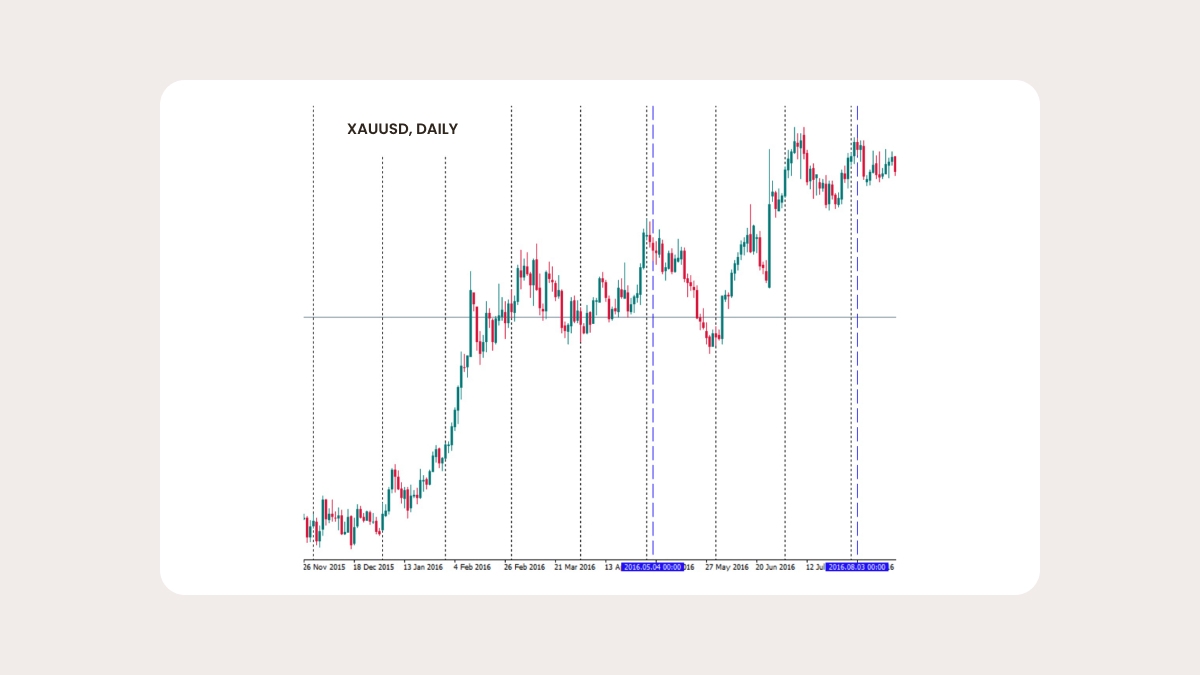

Jumping in right after news hits

Big reports like CPI, NFP, or Fed decisions can make gold prices very volatile. If you enter right away, there’s a good chance you’ll get shaken out before the real trend is revealed.

Ignoring bond yields

Don't only focus on the dollar. Bond yields adjusted for inflation are one of the main forces behind gold’s long-term moves. Trading against that current is a lot like trying to swim upstream.

Using too much leverage

TEXT WITH BACKGROUND Gold can move fast and hard.

There can also be big gaps after news breaks overnight. If your position is too big or you're using too much leverage, a sharp move can easily wipe out your account balance.

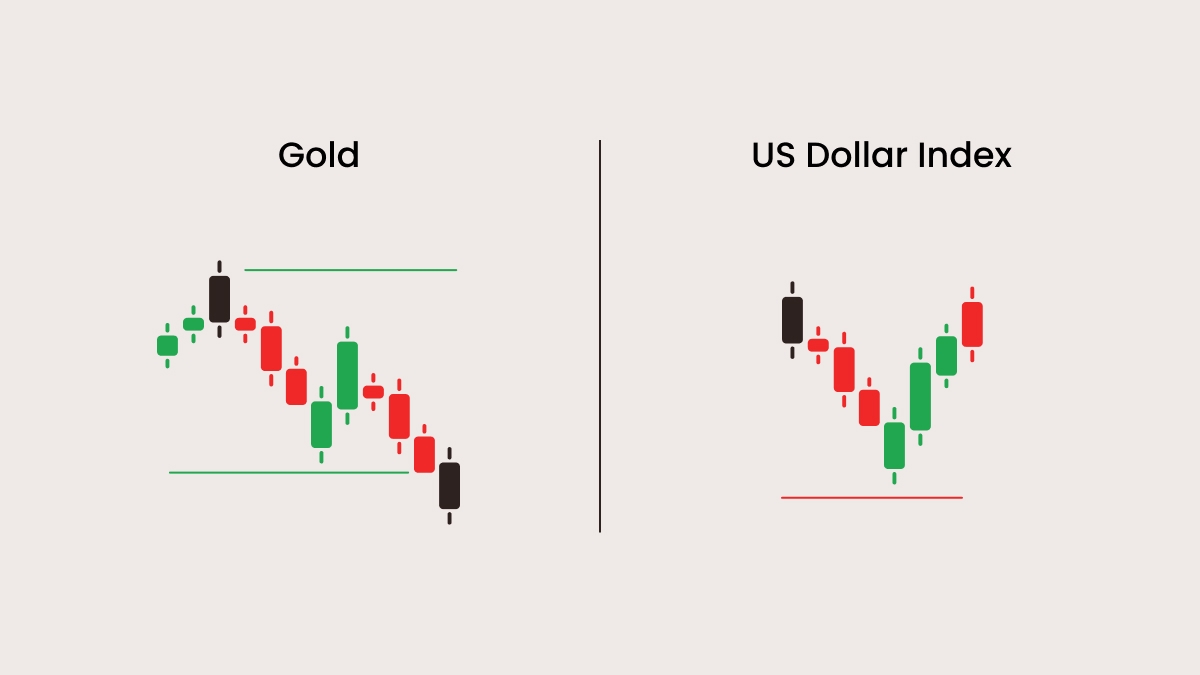

Relying on one correlation

Gold’s ties to the dollar or the aussie are useful, but they’re not ironclad. In a crisis, markets can break those relationships. Always check what price action is actually telling you before you trade.

Treating seasonality as a guarantee

Gold often rises early in the year, but that's not always the case. Take seasonal tendencies with a grain of salt. Wait for confirmation from charts or indicators before you trade.

Ignoring timing windows

A lot of volume flows in when the big gold auctions take place around 10:30 and 15:00 GMT. If you trade at quieter times, you may find yourself caught in a low-energy market without clear direction.

FAQs

What hours can I trade gold?

Gold (XAUUSD) trades almost around the clock. The most activity happens during the London and New York sessions, with extra liquidity around 10:30 and 15:00 GMT when auctions take place. Outside of these times, price movements can be slow and uneven.

What’s the minimum size to trade gold?

That depends on your broker. Many platforms let you start with a micro lot (0.01), which equals one ounce of gold. This smaller size is useful if you’re learning, as it keeps your risk manageable.

Why does gold react so strongly to news?

Gold is sensitive to data releases like CPI, NFP, and Fed rate decisions. These reports change expectations for inflation, yields, and the dollar, which all affect gold prices. The first minutes after news can be wild, so it’s usually safer to wait for direction before you enter.

Glossary

XAUUSD

The symbol for gold priced in US dollars. “XAU” is the code for one troy ounce of gold.

LBMA Fix

The London Bullion Market Association sets a reference price for gold twice a day. Big banks and institutions use it to price trades, and it often acts as an anchor for the market.

DXY

Short for the US Dollar Index. It measures the dollar against a basket of major currencies. Gold tends to move in the opposite direction, since it’s priced in USD.

Real yields

This is the return on government bonds after subtracting inflation. When real yields fall, gold usually gains appeal because it doesn’t pay interest. When they rise, gold often struggles.

Rollover

If you hold a gold position overnight, most brokers apply a small financing charge or credit. This “rollover” reflects the cost of carrying the trade past the market close.