Key Date: NVIDIA will release its quarterly earnings on Wednesday, November 19, 2025, after the close of Wall Street.

The market is closely watching this report, as the company remains at the center of the global artificial intelligence boom.

Why NVIDIA Matters

NVIDIA produces the most powerful chips in the world, called GPUs, which are the “brains” behind AI programs like ChatGPT or Gemini.

In recent years, demand for these chips has surged, driving the company’s value sharply higher.

Its strongest business is in Data Centers, large facilities where tech companies use thousands of NVIDIA chips to train AI models.

What the Market Will Watch in the Earnings

- AI Chip Sales:

Investors want to know if major tech companies — such as Microsoft, Amazon, and Google — continue buying at a strong pace. If they reduce spending, NVIDIA’s growth could slow. - Guidance for the Coming Months:

The company usually provides a revenue estimate for the next quarter. If this guidance comes in below expectations, the stock price could fall even if current results are strong. - Impact of Restrictions in China:

Since October, the U.S. government has banned NVIDIA from selling its most advanced chips to China, aiming to limit AI development there.

Additionally, the Chinese government has mandated that state-funded tech projects only use domestic chips.

As a result, NVIDIA can now barely sell in China, according to CEO Jensen Huang.

This matters because China represented around 25% of its Data Center sales. - Margins and Costs:

Another key point is whether NVIDIA can maintain profitability. Manufacturing advanced chips is increasingly expensive, and falling margins could signal pricing pressure.

Geopolitical Factors: A New Challenge for NVIDIA

Tensions between the U.S. and China have become a decisive factor.

The export ban means NVIDIA can no longer freely operate in one of the world’s largest markets.

The company now depends more on demand in the U.S., Europe, and other allied countries.

Analysts agree this situation could slow growth, even though the global AI market remains massive.

What Investors Expect

- Optimists believe global demand for AI chips will continue growing for many years. Even traditional companies—not just tech giants—are investing in AI.

- Cautious investors think the current stock price already reflects too much optimism, and lower guidance could trigger a correction.

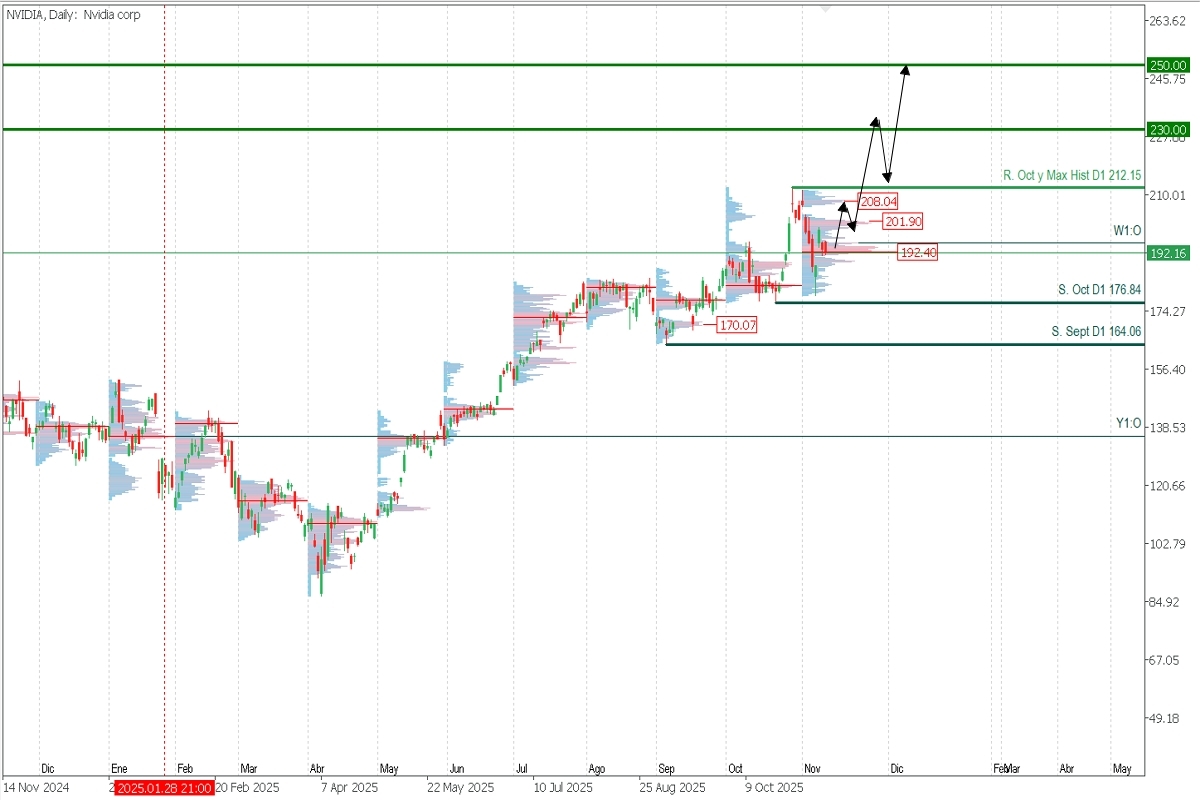

The average price target among analysts is between $230 and $250 per share, though more optimistic analysts see higher potential if earnings exceed expectations.

What Could Happen with the Stock

- Positive Scenario: Strong sales and optimistic guidance → stock could reach new highs.

- Neutral Scenario: Good results, but cautious guidance → stock may move sideways.

- Negative Scenario: Weak guidance or new regulatory blocks → potential short-term correction.

Technical Analysis | Daily

After reaching its all-time high in October at 212.15, NVIDIA’s price has corrected in November so far. However, there is a monthly volume concentration around 192.40, which currently acts as a demand zone and support. As long as the price stays above this level, the support remains valid.

The key daily support is the October low at 176.84. As long as the price does not break below this level, the main trend remains bullish.

Regarding long-term targets, the average projected price for the end of 2025 is between $230 and $250 per share.